Winter is coming

As we approached September, there was increasing concern around the upcoming winter. With both Covid-19 and seasonal flu circulating, the lack of immunity in the population meant conditions were set for a so-called ‘twindemic’. These concerns were heightened by the rising pressures facing the NHS including a lack of capacity, shortages of medical staff and disputes over pay driven by the cost-of-living crisis. These concerns were not unfounded as the number of patients with flu needing intensive care ‘skyrocketed’* in comparison to the previous year.

A media focus

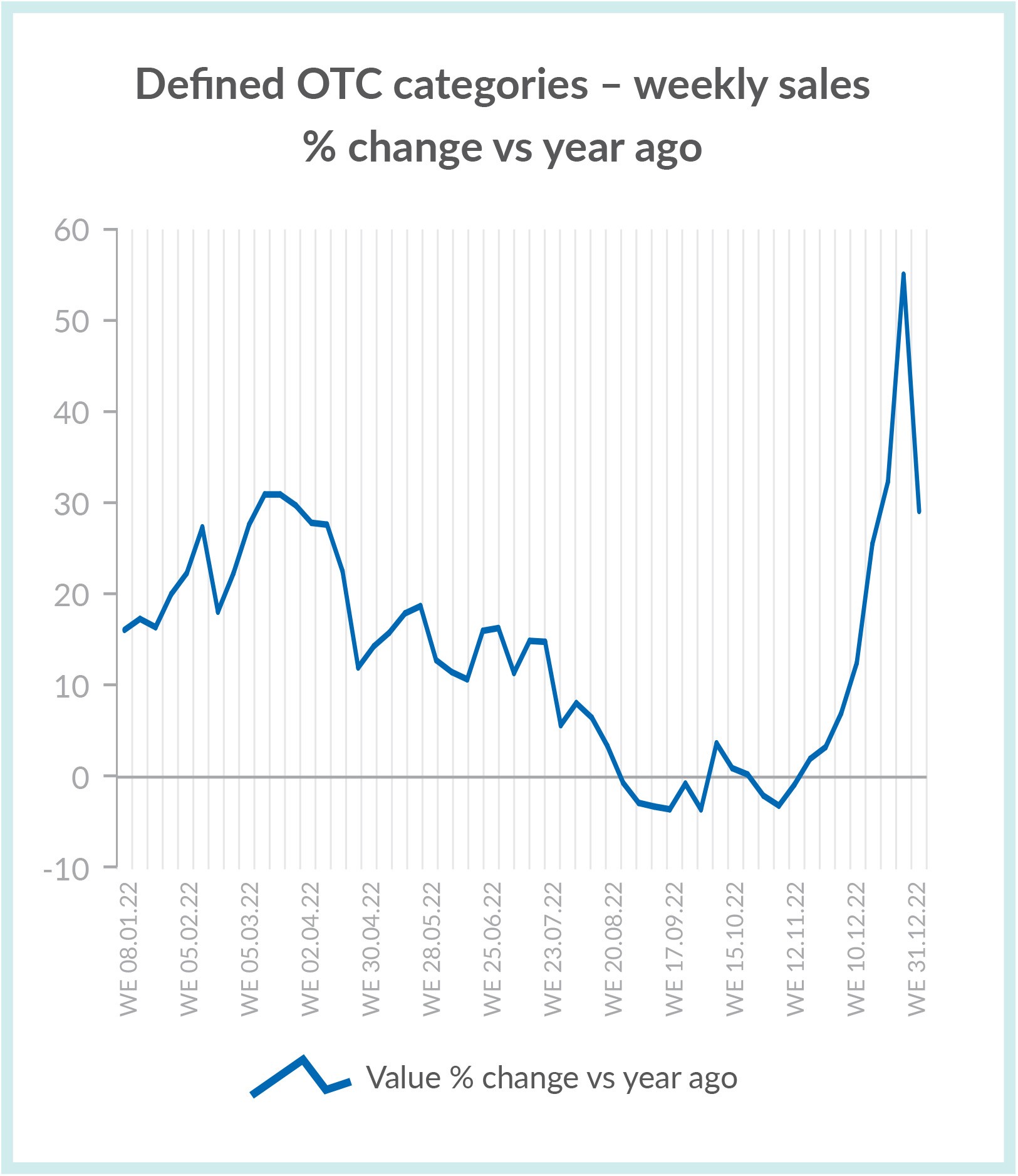

The end of the year saw increased media focus on health issues; in addition to flu and covid, there were rising concerns around the rise in cases of Strep A in children. OTC sales accelerated at the end of the year driven by the pain relief and cold, cough and sore throat categories as consumers focused on self-care to manage symptoms. In addition, there were widespread media reports around potential shortages of OTC products which accelerated demand further.

The impact of the cost-of-living crisis?

Ongoing pressures on the NHS, along with the cost-of-living crisis are forcing consumers to make different and difficult decisions when it comes to their finances. However, physical and mental wellbeing remain a priority for consumers, regardless of their financial situation (NielsenIQ State of the Nation 2022). Given the performance of the OTC sector during the year, we can see that OTC is more insulated than other categories and consumers will continue to prioritise their health in 2023.

What next?

The role of the pharmacist has steadily expanded in recent years, offering additional services such as stop smoking and weight loss services.

In June, pharmacies saw over 100,000 patients, an 83% increase on the previous year**

The role of pharmacists will continue to expand, playing a key role in relieving pressure on the NHS. Pharmacists are well placed to support consumer priorities around physical and mental wellbeing, demonstrating the vital role pharmacies can play in our community. Ensuring distribution into this channel will be even more important as the role continues to expand.

*NHS England » Two thirds increase in hospital flu cases amid rising staff absences and pressure on NHS 111

**NHS England » High street pharmacists treat thousands more people for minor illnesses

Source

NielsenIQ. Total Market MAT to WE 31.12.22 NielsenIQ’s OTC read was defined by NielsenIQ in agreement with PAGB and its members. It covers over 75,000 stores, including multiple and independent chemists, grocery retailers and in-store pharmacies, as well as impulse stores.

NielsenIQ (formerly known as Nielsen Global Connect) is a business unit of Nielsen holdings plc (NYSE: NLSN), a global measurement and data analytics company that provides the most complete and trusted view available of consumers and markets worldwide www.niq.com

Data and insight referenced in this review is taken from NielsenIQ’s different sources

NielsenIQ is an associate member of PAGB.